[3 minute read]

As the pandemic rages and certainty on almost everything is a daily moving target, one thing appears certain: we will not be returning to ‘normal’ anytime soon. And that means, the way we travel, commute, and vacation, at least in the medium-term, has changed.

WHAT’S ‘NORMAL’ ANYWAY?

While the world waits for a vaccine, travelers and commuters are increasingly hesitant to use traditional modes of transportation. A June 2020 survey of 11,000 people released by Dynata, a global online market research firm, found that:

- 30% surveyed do not feel comfortable flying until restrictions are lifted

- 40% surveyed no longer use taxi or rideshare services

- Public transportation usage is at only 60% of normal levels

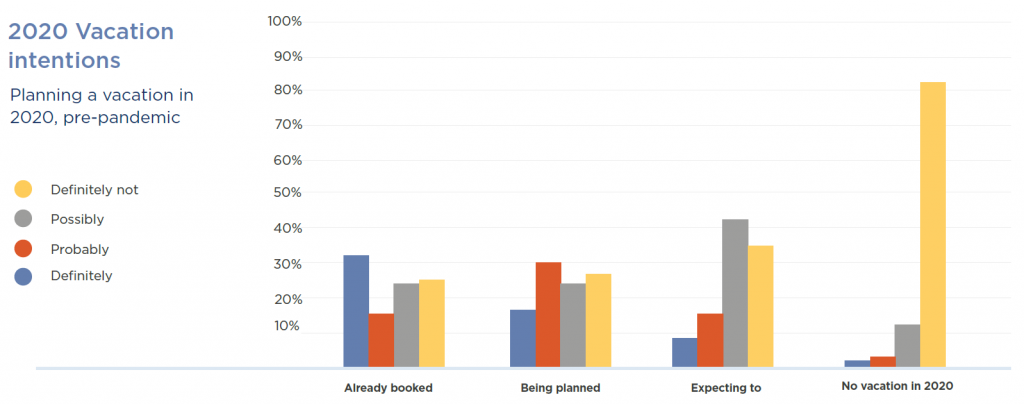

Additionally, >80% of respondents indicated they would ‘definitely not’ plan a vacation during the pandemic.

SAME ROADS, DIFFERENT VEHICLES

Reluctance to engage in air travel, public transit, taxi / ridesharing, and traditional vacation-planning has led consumers to seek alternative modes of transportation. This shift in behavior has resulted in an unprecedented shortage of bicycles and RVs. In April, U.S. bicycle sales (including accessories) hit $1 billion, up 75% from previous years. As of late-June, RV dealers have seen a 170% jump in RV turnover compared to the previous year. RV rentals have increased 1,600% since April.

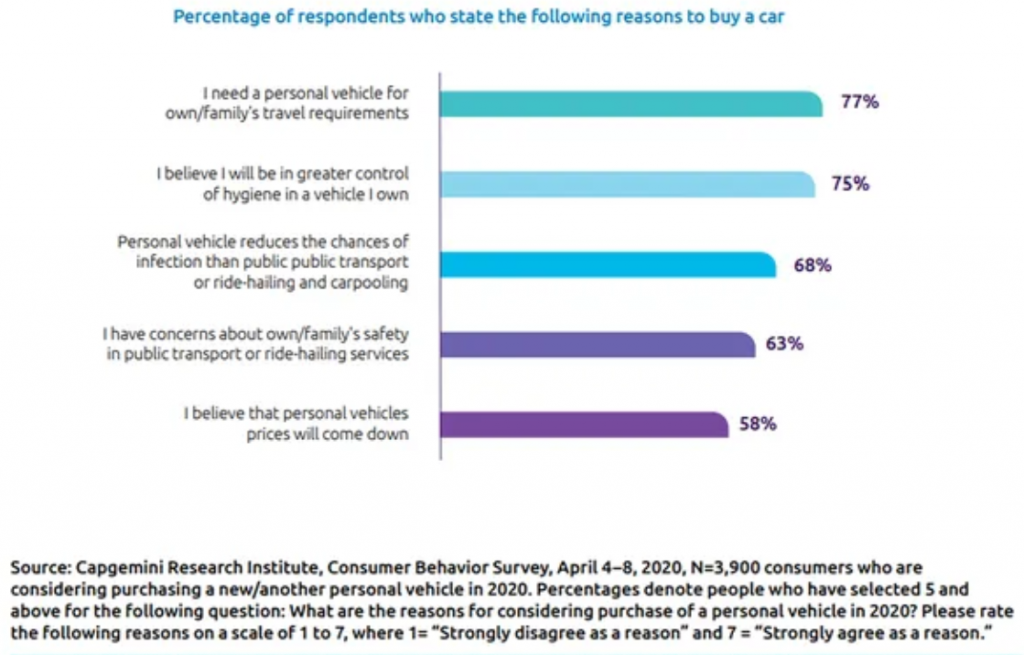

These trends are a by-product of an overwhelming belief that private vehicles are safer. In another April survey by consultancy, Capgemini, 75% of people indicated ‘greater control of hygiene in a vehicle I own’ as a key-driver for a car purchase.

IMPLICATIONS ABOUND

So, what are some potential implications of these trends? Severe bicycle shortages with record sales and spiking rentals indicate a ‘back-to-basics’ transportation approach for many. Travelers eschewing traditional vacation plans in favor of domestic travel in RVs and campers will mean vacationers hitting the highways and heading to (presumably) outdoor attractions. Increased private vehicle usage coupled with decreased ridesharing and public transit will potentially create congestion issues for commuters. Decreased public transit use will also mean a sizeable fare, toll, and dedicated tax revenue loss. An analysis of New York’s M.T.A. finances by consultancy McKinsey & Company projects losses as high as $8.5B by end of year.

SHIFTING GEARS

With this confluence of implications, how can transportation planners adapt? Planners in some of the hardest hit cities around the world from Paris to Oakland to Montreal have quickly pivoted to expanding bicycle and pedestrian options. In Paris, a plan to implement more than 400 miles of brand-new pop-up bike lines is already underway. Oakland has committed to making ~10% of streets car-free for the foreseeable future. Montreal is adding 70 extra miles of new bicycle and pedestrian paths. In Milan, a radical plan to shrink a major four-lane car road to only two, will support an effort to install six-foot wide bike lanes and pedestrian walkways.

CHANGING LANES

Ultimately these planners hope to not only adapt to the new travel implications, but to catalyze a paradigm shift in transportation. And while encouraging a shift to bike and pedestrian lanes will not address all pandemic-related transportation implications, a failure to do so could certainly aggravate conditions. And these changes will have to be implemented quickly. Former commissioner of NYC Transportation Department, Janette Sadik-Khan has stated that, “what might have been a 2030 plan is now a 2020 plan.” The U.K. has committed $2.6B to walking and cycling projects in the country, with $315M already fast-tracked for new bike and pedestrian infrastructure.

DRIVING A NEW FUTURE

While the future is far from certain, what we do know is that the future of travel is changing. What is required of transportation planners, now more than ever, is an ability to quickly adapt and collaborate. Technology will certainly play a key role in this. Especially as we remain sequestered at home waiting for a vaccine. Even once a vaccine has been approved, it may be some time before the threat of the virus is eradicated, if ever. What we can confidently say here at EcoInteractive is that we are with you, and we have your back. As transportation planners plan for a shifting future, our technology and transportation expertise are here to help in any way we can. Have thoughts? We’d love to hear from you. You can reach us at [email protected].